Spotting Red Flags: How to Identify Ponzi Scheme Websites

Ponzi schemes, high-yield investment programs (HYIPs), and pyramid schemes are some of the most deceptive forms of financial fraud, all crafted with one goal in mind: to take money from unsuspecting people. While each scheme operates differently, they all rely on deception to succeed.

In this article, I’ll break down how these scams work, share examples of infamous cases, and give you practical tips to spot them more easily.

About Ponzi Schemes

What is a Ponzi Scheme?

A Ponzi scheme is a type of financial fraud where returns for earlier investors are paid using the capital of newer investors, creating the illusion of a profitable venture. However, there is no actual profit being generated. The scheme's success depends entirely on continually recruiting new investors. Once it becomes difficult to attract new participants or if too many investors attempt to withdraw their funds at once, the scheme inevitably collapses.

What is a High-Yield Investment Program (HYIP)?

A High-Yield Investment Program (HYIP) is another form of investment scam that lures investors with the promise of exceptionally high returns. These programs often claim to offer significant profits with minimal risk. However, similar to Ponzi schemes, HYIPs use funds from new investors to pay earlier participants, rather than generating returns through legitimate investments. When the flow of new investments slows down, the program fails, leaving most investors with significant losses.

Ponzi Scheme vs. HYIP

While both Ponzi schemes and HYIPs promise high returns, they operate slightly differently. Ponzi schemes claim to offer consistent returns through a fraudulent business model, sustained by using new investors' money to pay earlier ones. The scheme falls apart when new investments dry up. HYIPs, on the other hand, entice investors with the prospect of rapid, unsustainably high returns, often providing little to no information about how the investments work. Like Ponzi schemes, HYIPs also depend on a continuous influx of new investors and collapse when that flow stops.

How to Spot Ponzi Schemes: Key Warning Signs

🔴 Unrealistic Returns Ponzi schemes and high-yield investment programs (HYIPs) often promise unusually high returns in a short time. This is a major red flag. While high returns are possible, consistently exaggerated profits should make you skeptical.

🔴 Claims of No Risk These schemes often claim to be risk-free or have very low risk. This is misleading because all investments carry some level of risk, especially those with high returns. If something sounds too safe, it’s worth questioning.

🔴 Vague Investment Strategies If a scheme can’t clearly explain how it generates returns, that’s a sign of trouble. Legitimate investments are transparent about how they make money, while Ponzi schemes keep it vague to hide their fraud.

🔴 Lack of Licensing Real investment opportunities usually have proper licenses and are regulated by financial authorities. If a scheme isn’t licensed, it’s likely operating outside the law.

🔴 Not Listed in Credible Directories Genuine businesses are often listed in reputable directories. If you can’t find the company in these resources, it might be because they’re trying to avoid scrutiny.

🔴 Guaranteed Profits Be wary of schemes that claim they can make money in any market condition. Real investments fluctuate with the market, while Ponzi schemes need new investors to pay the old ones, which isn’t sustainable.

🔴 Poor Website Quality Many Ponzi schemes use cheap website templates and have poorly designed sites. This could indicate a quick, fraudulent setup intended to deceive people before they’re caught.

🔴 Weak Social Media Presence Legitimate businesses usually have active and engaging social media profiles. In contrast, Ponzi schemes often have minimal social media activity, showing little interest in building trust with customers.

🔴 Preference for Cryptocurrency Payments Modern Ponzi schemes often ask for payments in cryptocurrencies like Bitcoin. This makes it hard to track the money and easy for scammers to operate without detection.

By keeping an eye out for these warning signs, you can protect your money and avoid falling victim to these scams. Remember, if an investment seems too good to be true, it probably is. Always do your research before investing.

Evaluating a Suspected Ponzi Scheme: bemarg.com

In this analysis, we’ll take a close look at bemarg.com, a website that might be a Ponzi scheme or High-Yield Investment Program (HYIP).

I’ll walk you through the steps to assess its legitimacy.

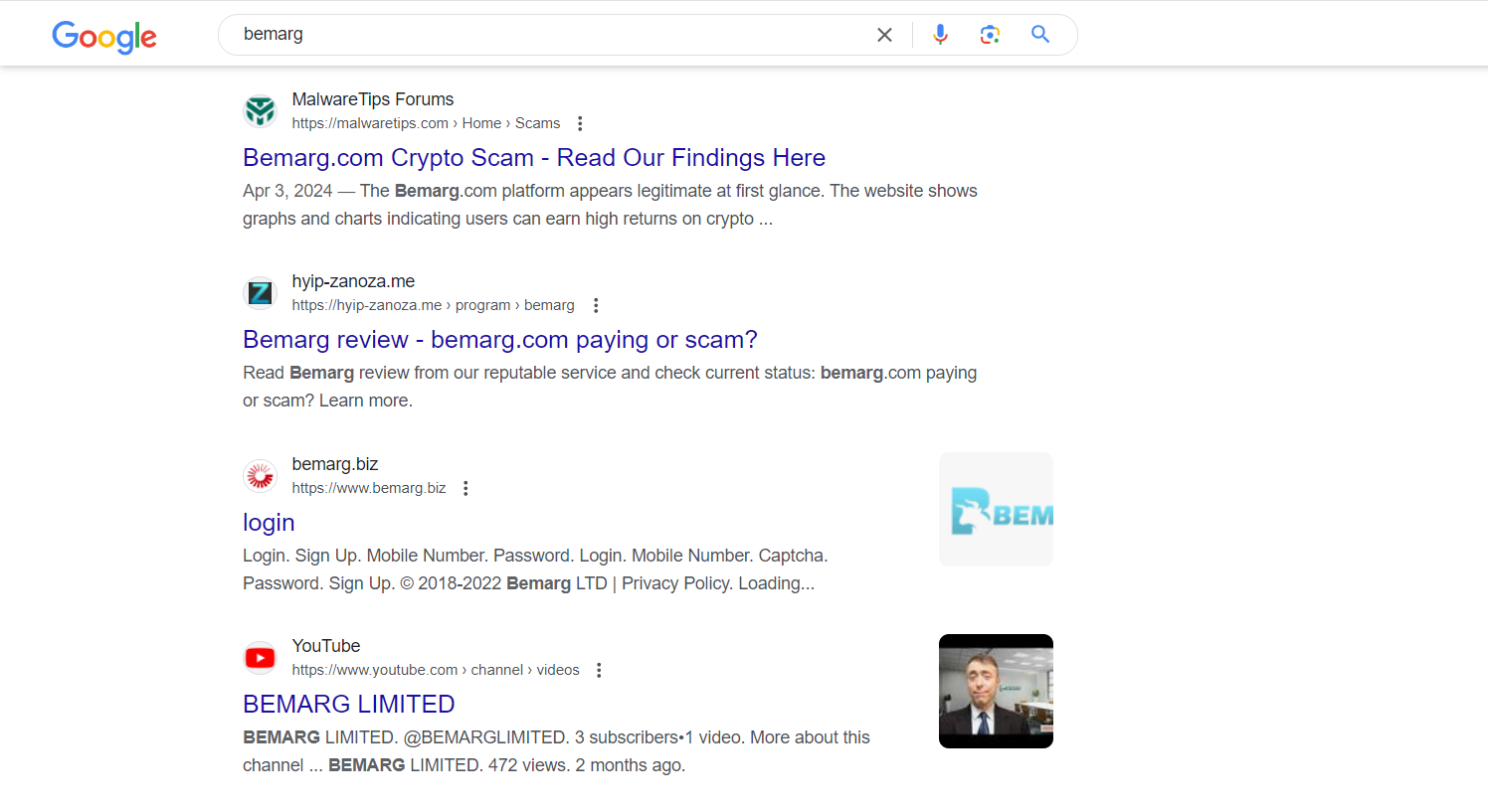

Checking Directory Listings

We begin by looking for bemarg.com in reputable business directories. Legitimate businesses typically appear in listings like Google Business Profile, Bing Places, and Yelp, as these provide an additional layer of credibility.

Process: I searched for bemarg.com across several business directories.

Result: The website was not found on any of the major directory platforms.

🚩 Red Flag: Not Listed in Business Directories

The absence of bemarg.com from these directories is a significant concern. This could mean the business is intentionally avoiding the verification process, which helps confirm its legitimacy.

Assessing the About Page

A trustworthy website usually has a well-crafted About page that provides detailed information about the company, including its founders, leadership team, and history.

Process: I reviewed the about page on bemarg.com.

Observation: The about page was minimal, offering little information about the company’s operations or leadership. It felt generic and possibly AI-generated.

🚩 Red Flag: Lack of Detail on the About Page

An About page with sparse or generic content is a major warning sign. Legitimate companies often emphasize transparency and highlight the strength of their team, reflected in detailed and informative About pages.

Social media presence

A strong social media presence often signals a company's legitimacy and transparency, as it allows businesses to interact with customers and build trust.

Process: I searched for official social media profiles for bemarg.com on platforms like Facebook, LinkedIn, and Twitter.

Result: No accounts related to bemarg.com were found on any of these platforms.

🚩 Red Flag: No Social Media Presence

The lack of social media activity is a common characteristic of Ponzi schemes. These schemes typically avoid public engagement on social media to reduce scrutiny and interaction, indicating they might not be committed to building long-term relationships with investors.

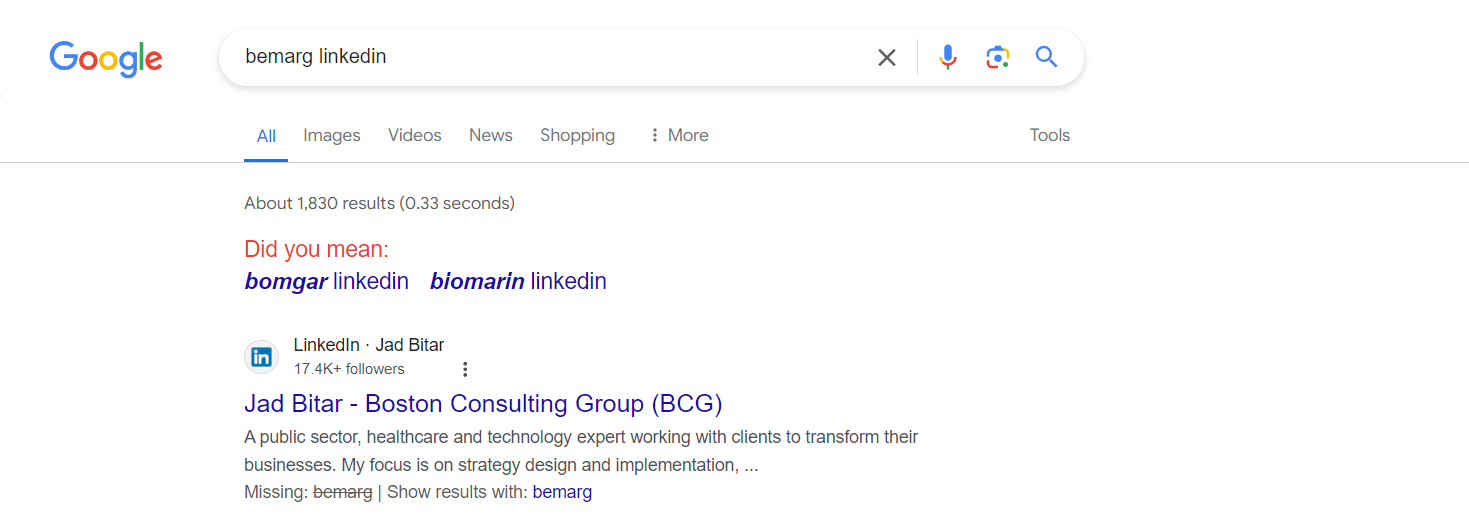

Reviewing Promised Returns

Promises of extraordinarily high returns in a short time are often a major red flag for fraudulent investment schemes.

Process: I checked the profit margins advertised on the bemarg.com website.

Observation: The site claims potential profits ranging from 1,500% to 20,000% over 55 to 500 business days.

🚩 Red Flag: Unrealistic Profit Margins

Such high returns are not only unrealistic but also typically impossible to achieve without significant risk or fraudulent activity. These figures are far beyond standard market returns, strongly indicating the likelihood of a Ponzi scheme.

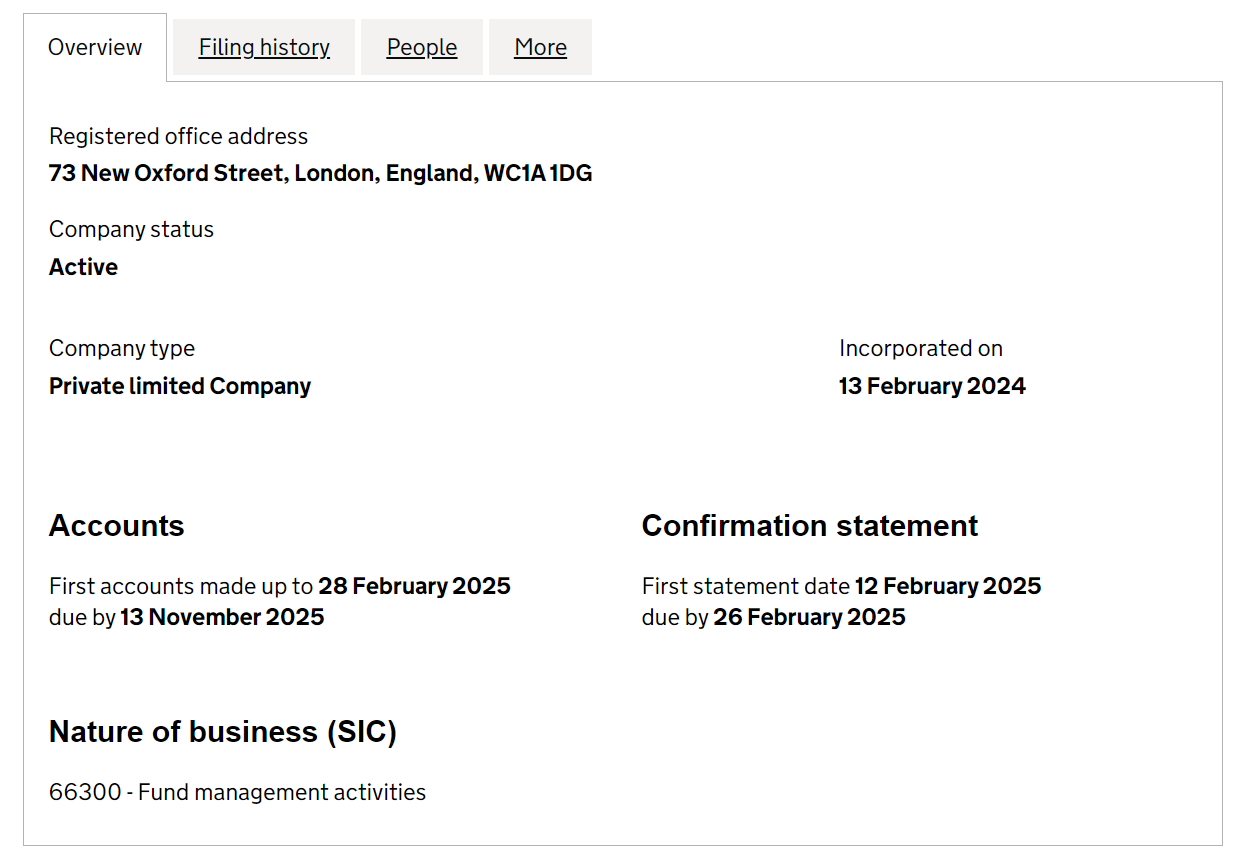

Verifying Company Registration and Licensure

Confirming a company's registration and licenses is essential for validating its legitimacy, particularly in the financial sector.

Process: I checked bemarg.com's registration status through the UK Companies House and reviewed its business classification.

Result: The site is registered as a "limited company" in the UK. However, simply being registered does not ensure that the company operates legally or ethically within the financial industry.

🚩 Red Flag: Missing Financial Licenses

Registering a company in the UK is relatively easy and doesn’t necessarily mean it operates legally in the financial market. For a company to offer investment services legitimately, it must be authorized and regulated by the Financial Conduct Authority (FCA) in the UK. The lack of such credentials for bemarg.com is a serious concern, casting doubt on its legitimacy and compliance with financial regulations.

Investigating WHOIS Records for Clues

Looking into the WHOIS records of a website can provide valuable insights, especially when dealing with financial or investment activities. Here’s how to check WHOIS data for bemarg.com:

Step-by-Step Guide:

- Visit a WHOIS Lookup Service: Go to a domain registrar’s website that offers WHOIS services, like whois.com.

- Search the Domain: Enter “bemarg.com” in the search field.

- Review the Results: Click on the "WHOIS" button to view the domain's registration details.

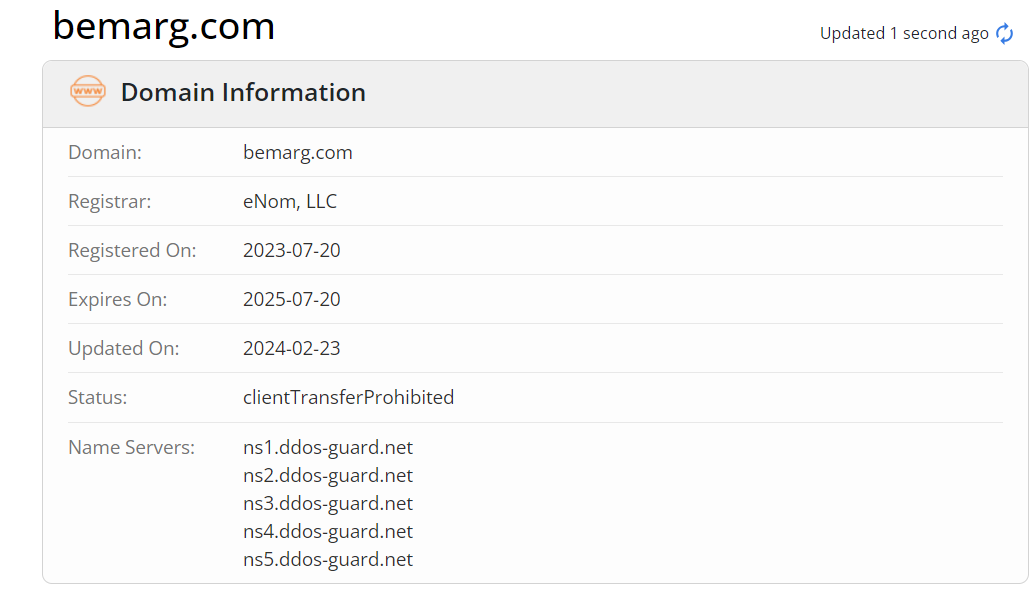

Key Information from WHOIS:

- Registered On: The date when the domain was first registered.

- Expires On: The date when the domain registration will expire.

Analysis of WHOIS Data:

- Domain Age: The age of a domain can indicate its trustworthiness. Older domains tend to be more reliable.

- Registration Length: A domain registered for a longer period suggests commitment. Short-term registrations might indicate a lack of long-term planning, often seen in fraudulent schemes.

Example from Current Analysis:

- Registration Date: bemarg.com was registered in 2023.

- Expiration Date: The domain is set to expire in 2025.

Interpreting the Findings:

- Short Registration Period: The fact that bemarg.com is only registered for two years is concerning. It suggests that the operators may not plan to keep the site active for long, a common tactic in Ponzi schemes and other fraudulent activities aiming for quick gains.

- Recent Registration: A newly registered site, especially in the investment sector, should be approached with caution. While not all new sites are scams, a recent setup in this field requires extra scrutiny due to the higher risks involved.

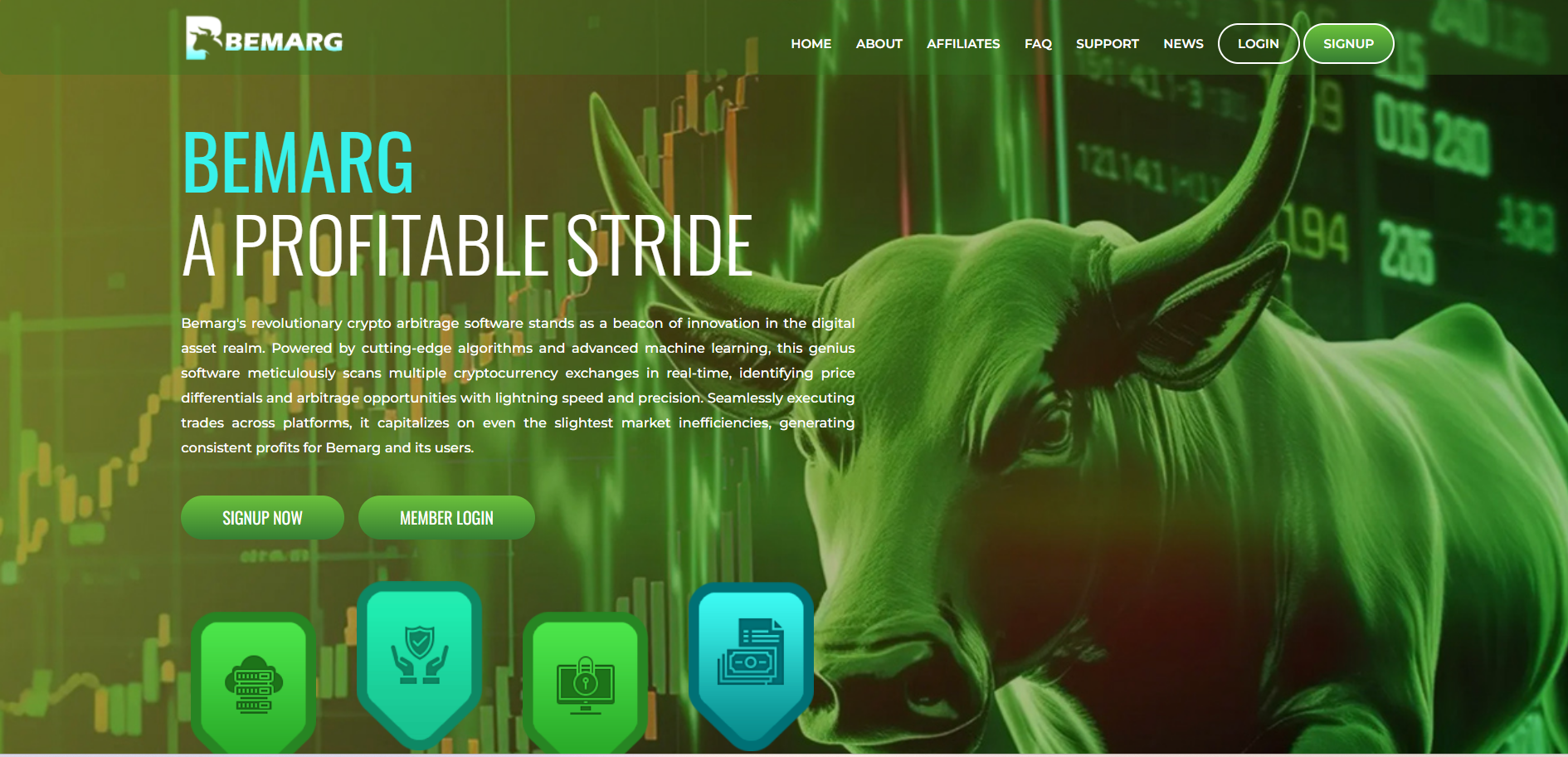

Assessing Website Design Quality

When evaluating investment websites, the quality of their web design can offer important clues about their legitimacy. Ponzi schemes often use cheap, generic templates because they don’t plan to operate long-term. This allows them to quickly create a site that looks legitimate on the surface without spending much.

Observation: As seen in the screenshot, bemarg.com uses a poorly executed design that isn’t mobile-friendly and lacks professionalism.

🚩 Red Flag: Poor Website Quality

A poorly designed website is a strong sign of a potential scam. Legitimate investment companies usually invest in a professional, well-crafted website to build trust and provide a positive user experience, reflecting their commitment to their clients.

The Importance of Transparency in Investment Strategies

Transparency about investment strategies is essential for any trustworthy financial service provider. Investors need clear and detailed information to make informed decisions.

Observation: bemarg.com provides very little information about how it manages or invests user funds, with only a brief mention of its investment approach.

🚩 Red Flag: Lack of Investment Details

The lack of clear, detailed information about investment strategies is a significant warning sign. It suggests that there may not be any real investment activities happening. Legitimate firms usually provide comprehensive details about their strategies to build trust and confidence among potential investors.

The Role of Affiliates in Ponzi Schemes

Heavy reliance on affiliates is a common trait of Ponzi schemes and High-Yield Investment Programs (HYIPs). These schemes often focus more on recruiting new investors than on generating real profits.

Observation: bemarg.com places a strong emphasis on recruiting affiliates, aiming to grow its operations by collecting more funds through a network-driven approach.

🚩 Red Flag: Focus on Affiliate Recruitment

Ponzi schemes often use affiliates to maintain the appearance of a profitable business. This strategy is crucial for the scheme’s growth and survival, as it keeps cash flowing without the need for significant advertising or legitimate business activities.

Payment methods

The choice of payment methods offered by a website can also be a red flag. Cryptocurrencies provide anonymity and are difficult to trace, making them a preferred option for fraudulent schemes.

- Observation: bemarg.com primarily accepts payments in cryptocurrencies, which complicates the process for victims seeking to recover funds.

🚩 Red Flag: Exclusive Crypto Payments

The exclusive acceptance of cryptocurrencies by bemarg.com indicates a desire to avoid regulatory oversight and reduce the traceability of transactions. This setup is typical of Ponzi schemes, utilizing the privacy of digital currencies to obscure and transfer illicit gains.

The Result:

The combination of poor website quality, lack of detailed investment information, reliance on affiliates, and exclusive use of cryptocurrencies are substantial indicators that bemarg.com is operating as a Ponzi scheme. Potential investors should exercise extreme caution and consider these red flags as strong reasons to avoid involvement with this site.

Software Engineer's Analysis

Deep website analysis

I conducted a thorough analysis of the website and accessed parts of its code, which led me to identify the company that created the website.

I won't disclose the provider's name to prevent misuse in creating other Ponzi schemes.

However, here are some findings:

- The website template costs only $30.

- It's the same one used by thousands of other websites.

- The website has backlinks from HYIP monitors and scam detectors.

Sadly, it's all too easy to set up such a website, get it registered in the UK, and start scamming people, often without detection by the average user. This is precisely why I've created this guide—to help you recognize a Ponzi scheme.

There are many currently active, siphoning money from unsuspecting individuals. Please be cautious and ensure that you only invest with highly reputable companies.

FREE Legitimacy Analysis by Mohamed Soufan

Are you considering an investment but unsure about the website's credibility? I'm here to help. Reach out to me, and I'll assist you in verifying the legitimacy of the website.

The thought of people falling prey to scams on a daily basis is something I find deeply unsettling. That’s why I offer my support. So, if you’re in need of guidance, please don't hesitate to get in touch.

Your peace of mind is important, and I'm committed to helping you invest safely.

FAQs for Spotting Ponzi Schemes and HYIPs

What is a Ponzi scheme?

A Ponzi scheme is a fraudulent investment scam promising high rates of return with little risk to investors. The scheme generates returns for earlier investors by acquiring new investors, not through legitimate business activities.

How can I spot a Ponzi scheme?

Look for red flags such as unrealistic high returns, claims of no risk, vague investment details, absence of a business license, poor web design, lack of social media presence, and an emphasis on recruiting new investors rather than generating actual profits.

What are the common signs of a high-yield investment program (HYIP) scam?

HYIP scams often promise exceptionally high returns, use vague investment terminology, lack credible registration or licensing, and focus heavily on recruiting new members to sustain payout structures.

Why do Ponzi schemes and HYIPs focus on recruiting new investors?

These schemes rely on new investments to pay returns to earlier investors, as they do not engage in any real, profitable business activities. The continuous influx of new funds keeps the scheme operational.

Are there any safe investment websites?

Yes, legitimate investment websites are transparent about their business operations, are properly licensed, and provide realistic information about risks and returns. Always verify the authenticity of any investment site through reliable sources before investing.

Why do Ponzi schemes use Cryptocurrencies?

Ponzi schemes often prefer cryptocurrencies because they provide anonymity and are difficult to trace. This makes it easier for scammers to avoid regulation and makes it harder for victims to get their money back.

Is Bemarg.com Safe?

Based on software engineer Mohamed Soufan's analysis, bemarg.com is not considered safe. The site shows several red flags typical of Ponzi schemes, including unrealistic profit promises, lack of transparency in investment strategies, absence from reputable business directories, and a focus on recruiting affiliates rather than legitimate business operations. Caution is advised when dealing with this website.

Conclusion

Navigating the world of online investments can be tricky, with options ranging from truly beneficial opportunities to complete scams. This guide has given you the tools to identify potential Ponzi schemes and deceptive investment sites, but remember, staying vigilant and skeptical is key.

Always be wary if an investment sounds too good to be true—it usually is.

As part of my commitment to helping you stay safe, I offer a free service to review and analyze investment websites to help determine their legitimacy.

Open Invitation: If you're ever unsure about an investment, don't hesitate to reach out. I urge you to consult with a professional for a detailed analysis before making any financial commitments. Taking a moment to verify can save you from significant losses. So, invest smartly and remember that professional guidance is just a request away when you need it.